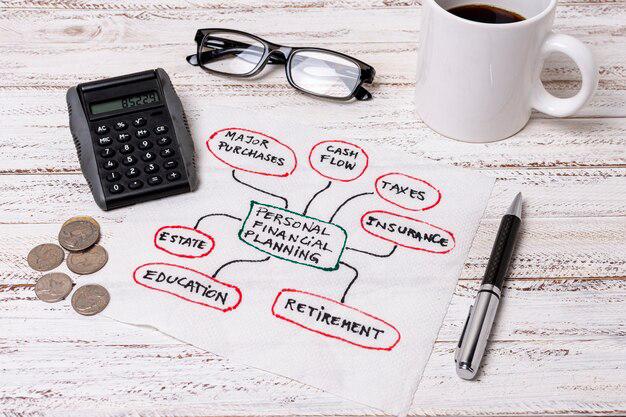

Financial success requires planning, discipline, and smart investment choices. As 2025 unfolds, understanding the best personal finance strategy will help Nigerians build financial security and achieve financial freedom. With economic changes, inflation, and shifting market trends, having a strong financial plan is essential.

-

Prioritize Budgeting for Stability

Budgeting is the foundation of personal finance. It helps track expenses, control spending, and allocate funds effectively. Nigerians should create a detailed budget, prioritizing necessities like housing, healthcare, and savings. Using an investment app can simplify budgeting and ensure financial discipline.

Pro Tip:

- Follow the 50/30/20 rule—50% for needs, 30% for wants, and 20% for savings and investments.

- Use tools like the FSDH Asset Management investment platform to track financial goals.

-

Invest in Mutual Funds for Steady Growth

Mutual funds offer diversified investment opportunities, reducing risk while maximizing returns. Whether for long-term wealth creation or short-term gains, mutual funds are a great way to grow money without deep market knowledge.

Why Choose Mutual Funds?

- Professionally managed by experts at asset management companies in Lagos.

- Offer better Return on Investment than traditional savings accounts.

- Lower investment risks through diversification.

FSDH Asset Management provides Portfolio Management Services in Nigeria, ensuring optimal asset allocation based on individual financial goals.

-

Strengthen Financial Literacy for Smarter Decisions

Many Nigerians struggle with financial decisions due to a lack of financial literacy. Understanding investments, savings plans, and debt management improves financial security.

How to Improve Financial Literacy:

- Read books and attend finance seminars.

- Follow financial experts and platforms for financial updates and market trends.

- Use an investment app for real-time financial insights.

FSDH Asset Management provides expert guidance, helping Nigerians navigate investments confidently.

-

Diversify Your Investment Portfolio

A strong personal finance strategy involves diversifying investments to reduce risks. Relying on a single income stream or investment can be risky.

Diversification Strategies:

- Combine mutual funds, stocks, real estate, and fixed deposits.

- Invest in foreign assets for currency stability.

- Use a trusted financial advisory firm in Nigeria for tailored investment solutions.

FSDH Asset Management offers customized Portfolio Management Services in Nigeria, ensuring a balanced and profitable investment approach.

-

Secure Your Future with Long-Term Financial Planning

Long-term financial planning ensures financial freedom and stability. Nigerians should prioritize retirement plans, emergency funds, and insurance.

Steps to Long-Term Financial Planning:

- Open a retirement savings account.

- Set up an emergency fund covering six months of expenses.

- Consult an asset management company in Lagos for long-term investment strategies.

-

Maximize Returns with the Right Investment Platform

Choosing the right investment platform impacts returns and risk management. FSDH Asset Management offers a secure, transparent, and high-performing platform tailored for Nigerian investors.

Key Features of a Good Investment Platform:

- Low transaction fees.

- User-friendly interface with market insights.

- Access to professional funds management services.

-

Understand Risks and Manage Them Wisely

All investments come with risks. A good personal finance strategy includes risk assessment and management.

Common Risks in Investments:

- Market volatility affecting Return on Investment.

- Inflation reducing purchasing power.

- Fraud risks from unregulated financial schemes.

To mitigate risks, partner with licensed firms like FSDH Asset Management, a trusted financial advisory firm in Nigeria.

Final Thoughts – Take Control of Your Financial Future

Mastering personal finance in 2025 requires budgeting, investing in mutual funds, improving financial literacy, and diversifying investments. Working with a reputable firm like FSDH Asset Management in Nigeria ensures smarter investment choices and better financial outcomes.

Partner with FSDH Asset Management – Grow Your Wealth Strategically with FSDH’s Expert Investment Solutions.

Contact us today at [email protected], 0201 700 8900, or visit www.fsdhaml.com to learn more.