Achieving financial security requires smart investment decisions. Many Nigerians struggle with saving and growing wealth due to inflation and economic instability. One of the best ways to secure your financial future is through mutual funds. These professionally managed investment vehicles help you earn competitive returns while minimizing risk.

In this article, we explore how mutual funds can protect your wealth, offer financial stability, and provide a pathway to financial freedom.

What Are Mutual Funds?

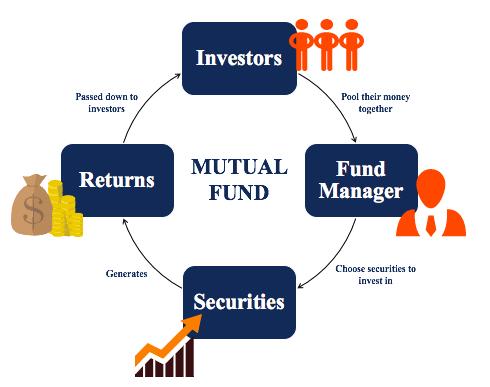

A Mutual fund pools money from multiple investors and invests in stocks, bonds, and other securities. Professional fund managers handle investments, reducing the burden on individuals.

Why Mutual Funds Are Ideal for Nigerian Investors:

✔️ Diversification: Spreads investments across multiple assets, reducing risk.

✔️ Liquidity: Easy to buy and sell without penalties.

✔️ Professional Management: Experts make informed investment decisions.

✔️ Affordability: Allows small and large investors to participate.

FSDH Asset Management in Nigeria provides expertly managed mutual funds, ensuring investors achieve financial security with reduced risk.

How Mutual Funds Help Secure Your Financial Future

- Steady Growth and Competitive Returns

Investing in mutual fund allows your money to grow over time. Unlike savings accounts, mutual funds provide higher Return on Investment (ROI).

Some funds focus on stable growth, while others offer aggressive strategies for higher potential returns. Your choice depends on your risk appetite.

- Helps You Overcome Inflation

Inflation erodes the value of money. Keeping cash in a bank account leads to declining purchasing power.

Mutual funds offer higher interest rates than savings accounts, protecting your wealth from inflation’s impact.

FSDH Asset Management in Nigeria offers expertly managed funds that help you preserve and grow your wealth.

- Offers a Hands-Free Investment Approach

Many Nigerians lack the time or knowledge to monitor investments daily. Mutual fund eliminate this challenge.

Fund managers handle:

✔️ Research and analysis

✔️ Buying and selling assets

✔️ Risk management

You earn returns without actively managing your investment.

- Low Entry Barriers for Investors

Unlike real estate or stock market investments, mutual fund allow you to start small. Many funds accept investments as low as ₦5,000.

This makes mutual funds a great option for anyone looking to secure their financial future without needing a large capital outlay.

- Ideal for Budgeting and Long-Term Goals

Mutual fund help with budgeting by encouraging disciplined investing.

How to Use Mutual Funds for Financial Planning:

✅ Emergency Fund: Invest in money market funds for quick access to cash.

✅ Retirement Planning: Long-term funds help build wealth for the future.

✅ Children’s Education: Plan for school fees with secure investments.

By consistently investing, you achieve financial freedom faster.

Choosing the Right Mutual Funds in Nigeria

Not all mutual funds are equal. Choosing the right one requires understanding your goals and risk tolerance.

Factors to Consider Before Investing:

- Investment Objectives: Do you want steady income, long-term growth, or capital preservation?

- Risk Level: Some funds focus on safety, while others offer higher potential returns with more risk.

- Liquidity Needs: If you need quick access to cash, choose a liquid fund.

FSDH Asset Management in Nigeria offers a range of mutual funds to suit different financial goals.

The Role of an Investment Platform in Growing Your Wealth

Technology makes investing easier. Using an investment app or investment platform simplifies the process.

Benefits of Using an Investment Platform:

✔️ Easy fund selection and investment tracking

✔️ Automatic investment options

✔️ Secure transactions

A financial advisory firm in Nigeria, like FSDH Asset Management, helps clients choose the best platforms for seamless investing.

The Risks of Mutual Funds Investments

While mutual funds offer great benefits, they also come with risks.

Common Risks:

❌ Market Fluctuations: Fund value changes based on economic conditions.

❌ Management Risks: Poor decisions by fund managers can affect performance.

❌ Liquidity Risks: Some funds may have withdrawal restrictions.

To reduce risks, always invest with reputable asset management companies in Lagos like FSDH Asset Management.

Final Thoughts: Secure Your Financial Future with Mutual Funds

Mutual funds provide a safe, effective way to build wealth and achieve financial freedom. They offer steady returns, professional management, and inflation protection.

Whether you’re a beginner or an experienced investor, mutual fund can help you secure your financial future.

Partner with FSDH Asset Management – Grow Your Wealth Strategically with FSDH’s Expert Investment Solutions.

Contact us today at [email protected], 0201 700 8900, or visit https://www.fsdhaml.com/ to learn more.